Supporting Working Families

State-level indicators show the Tennessee economy is doing better than ever. But behind our strong economic growth is a hard reality: Not all Tennesseans are benefiting equally, and many working families are struggling to achieve economic security.

Making Ends Meet

Half of Tennessee families depend on a female breadwinner, but 40 percent of female-headed households in Tennessee live in poverty. Whether rural, urban or suburban, Tennesseans struggle with high levels of debt. And a third of Tennesseans overall report they’re worried about making ends meet.

Moving Tennessee Families Forward

To move Tennessee forward, ThinkTennessee is pushing for evidence-based solutions that support working families and help more Tennesseans benefit from our strong economy:

- Ensuring that debt isn’t a barrier to economic mobility or civic engagement.

- Helping more women join and stay in the workforce.

- Pushing for reforms that ensure court fines and fees don’t keep Tennesseans stuck in a cycle of poverty.

Research

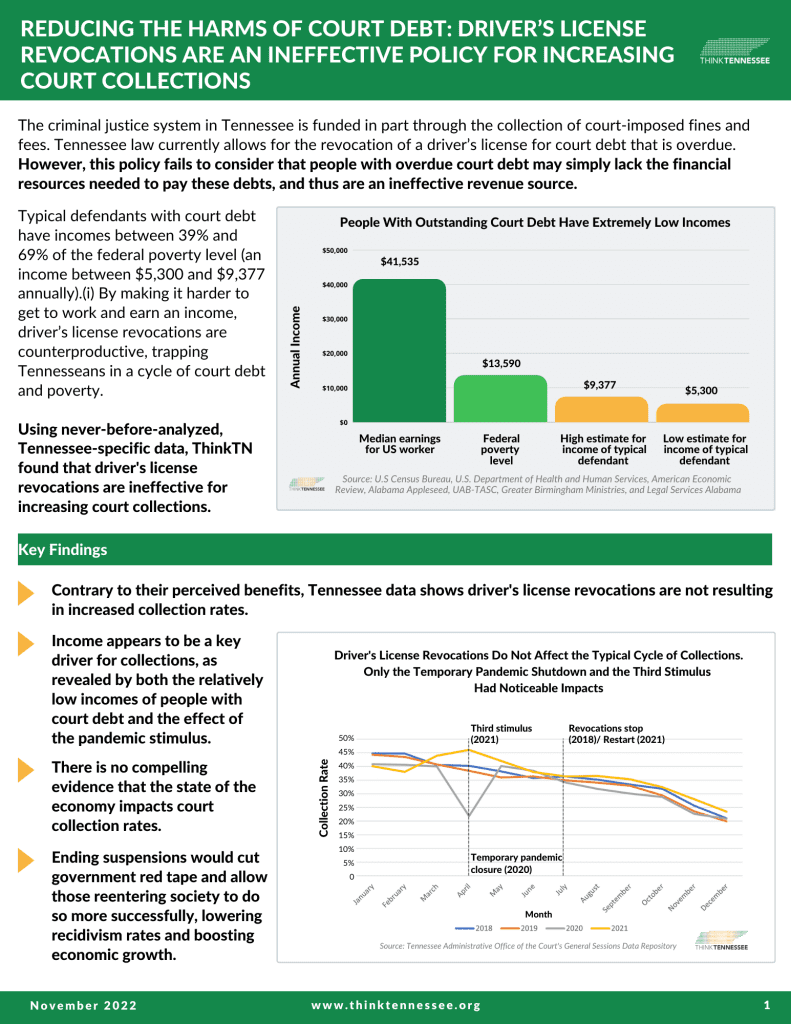

Reducing the Harms of Court Debt: Driver’s License Revocations are an Ineffective Policy for Increasing Court Collections (2022)

This brief evaluates the impact of driver’s license revocations and finds no meaningful effect on court debt collection rates in Tennessee.

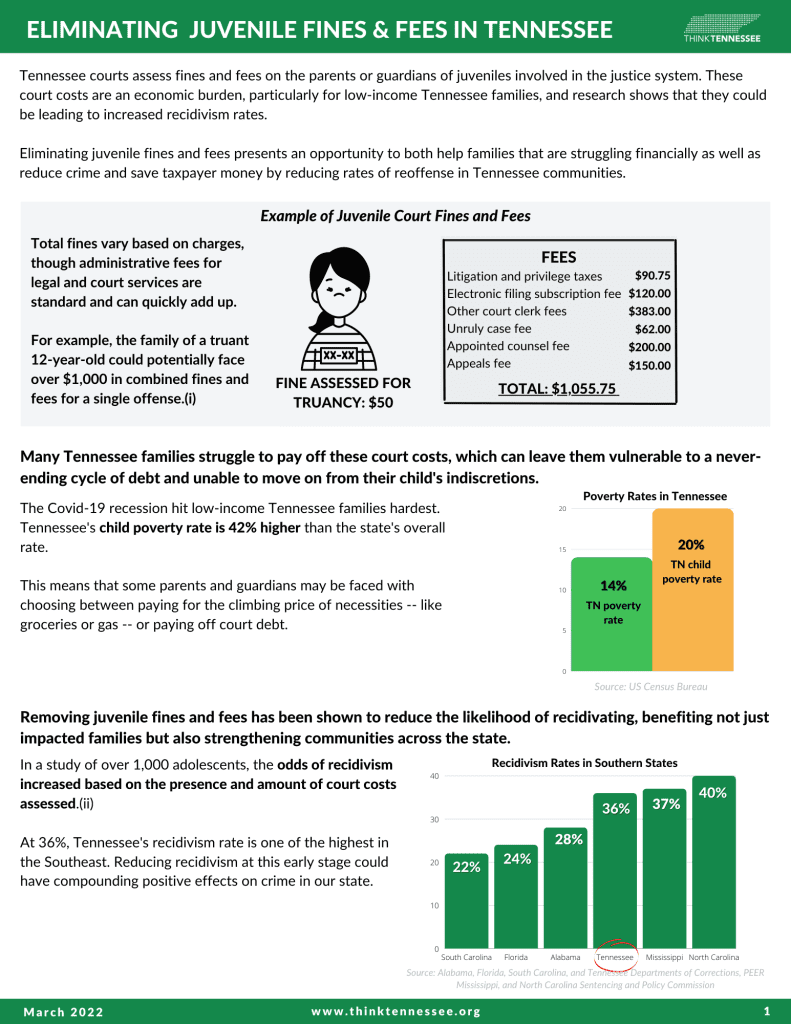

ELIMINATING JUVENILE FINES & FEES IN TENNESSEE (2022)

This brief describes the inequitable impact of juvenile fines and fees and underscores how their elimination would help Tennessee families and save taxpayer dollars by reducing recidivism rates in Tennessee communities.

BEYOND PAYMENT PLANS: BREAKING THE CYCLE OF COURT DEBT IN TENNESSEE (2021)

This three-part series provides details on Tennessee’s system of fines and fees, including findings from a phone survey of county court clerks, and outlines additional steps Tennessee policymakers and practitioners can take to close gaps in payment- plan access and further alleviate the adverse effects of court debt on individual defendants and the public as a whole.